Upfront Healthcare brings in $11.5 million in a Series B

Plus two prop-tech deals in Chicago and Indiana, data, and language learning.

Welcome to Excoastal, a newsletter covering deals, startups, venture capital, and more from Chicago to Boulder, Detroit to Columbus, and beyond. I’m Evan Lonergan, a native Midwesterner.

You can connect with me on Twitter @evanjlonergan, on Medium, and send deals/jobs/intel to evanlon92@gmail.com

What’s New

Excoastal Stats 📊

Last Week’s Open Rate: 36%

Last Week’s Views: 157

ICYMI: the Excoastal Investors Airtable sheet:

Midwest Venture Capital Firms and Angels

Excoastal will be off next week!

I’ll be taking exams next week and the week after. Have a safe and happy Thanksgiving however you’re able to celebrate it this year! 🦃 🍂 👨🏻💻

Venture Capital Deals

📍 Chicago

NestEgg, a management app for single-family and small multifamily homes, raised $7 million in Series A funding. Hyde Park Venture Partners led, and was joined by BAM Ventures, Bonfire Ventures, Financial Studio Ventures, Dreamit Ventures, and Hyde Park Angels.

Upfront Healthcare, a communication, and patient engagement platform raised $11.5 million in Series B funding. Baird Capital and LRVHealth co-led the round and were joined by Echo Health Ventures, Nashville Capital Network, and Hyde Park Venture Partners.

📍 Indiana

Realync Corp., a Carmel-based multifamily virtual leasing site, raised $22 million. Susquehanna Growth Equity invested. Term Sheet

📍 Pittsburgh

Language-learning platform Duolingo, raised $35 million in funding at a $2.4 billion valuation from Durable Capital Partners and General Atlantic.

📍 Toronto

Aya Payments, a healthcare payments startup, raised $2.9 million in funding. MaRS Investment Accelerator Fund and Luge Capital co-led the round, joined by Anthemis Group, BDC Capital, and StandUp Ventures.

📍 Boulder/Denver

Highwing, a Denver-based open data platform for insurance brokers and carriers, raised $4 million in seed funding co-led by Baldwin Risk Partners and BrokerTech Ventures.

Nymbl Science, a Denver-based provider of a fall prevention solution in the healthcare space, raised $4 million in Series A funding. Cobalt Ventures led the round. Term Sheet

📍 Texas

Austin-based ZenBusiness, a provider of micro-business formation and management platform, raised $55 million in Series B funding. Cathay Innovation led, joined by GreatPoint Ventures, Breyer Capital, Omega Venture Partners, and return backers Greycroft, Lerer Hippeau, Interlock Partners, Mark VC and ATX Venture Partners.

ClosedLoop.ai, an Austin-based developer of an AI-driven platform to help medical professionals predict likely patient outcomes, raised $11 million in Series A funding. Greycroft and .406 Ventures led the round and were joined by investors including Silicon Valley Bank and Meridian Street Capital. Term Sheet

ActivTrak has raised $50 million in a round led by Sapphire Ventures, with participation from Elsewhere Partners according to Pitchbook. The Austin-based company is the developer of a productivity analytics platform designed to monitor employee performance.

Private Equity Deals

Warburg Pincus invested in Quantum Health, a Columbus-based consumer healthcare company.

General Atlantic invested in Torchy’s Tacos, an Austin-based Taco restaurant, alongside D1 Capital Partners, T. Rowe Price, and Lone Pine Capital.

DW Healthcare Partners invested in CareXM, a Lehi, Utah-based provider of virtual care and patient engagement solutions for post-acute and non-acute health care providers. Axios

M&A

Wunderkind, formerly BounceX, plans to acquire SmarterHQ, an Indianapolis-based provider of a marketing platform. SmarterHQ is backed by investors including Battery Ventures.

AutoQuotes, backed by Luminate Capital Partners, acquired Axonom, a Minnesota-based provider of virtual reality technologies.

Belcan acquired Avista, a Platteville, Wisconsin-based provider of software engineering services to those in the aerospace, defense, industrial, and medical industries. Term Sheet

New Funds

Nashville-based Council Capital has closed its fourth fund on $200 million in outside commitments. The fund primarily targets lower-middle-market investments in the healthcare services and healthcare IT sectors.

Others

What I’m Reading

The New Status Game for Companies: Fewer Employees

Sports Tech Startups Find A Homebase In Indianapolis

The (Neo) Bank Bundle & Transition to Subscription Revenue

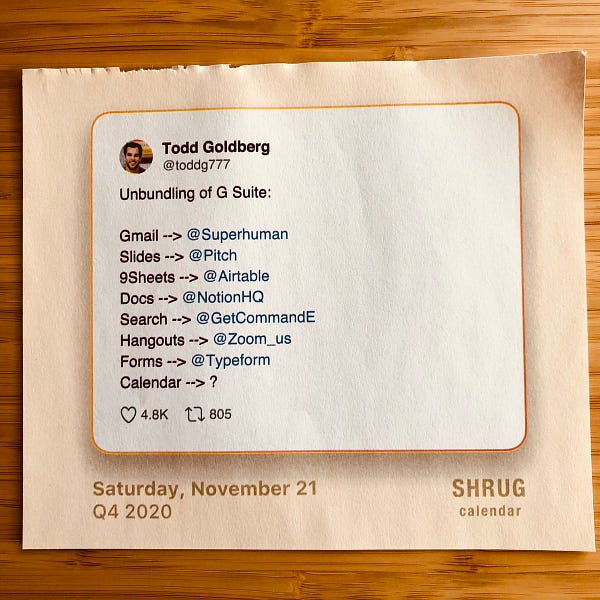

Startup/VC Twitter

Podcast Addiction

David Willbrand: An Attorney's Perspective on Startups and the Legal Implications of Big Tech - Middle Tech

Culture Break

📚Read- The Spymasters by Chris Wipple

🎬Watch- The Queen’s Gambit - Netflix

🎧Listen-

🧐Think- The Thanksgiving Myth Gets a Deeper Look This Year

If you like Excoastal and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great week!