Mandolin raises a $5M dollar seed round

Plus Cooler Screens, a big week for healthtech, fitness coaching, and more...

Welcome to Excoastal, a newsletter covering deals, startups, venture capital, and more from Chicago to Boulder, Detroit to Columbus, and beyond. I’m Evan Lonergan, a native Midwesterner.

You can connect with me on Twitter @evanjlonergan, on Medium, and send deals/jobs/intel to evanlon92@gmail.com

What’s New

Excoastal Stats 📊

Last Week’s Open Rate: 43%

Last Week’s Views: 183

On the Radar

🧑💻 Virtual Startup Wisconsin Week is coming up in November. See the schedule here.

2020 Inno On Fire - 50 people and companies heating up Chicago tech

ICYMI: the Excoastal Investors Airtable sheet:

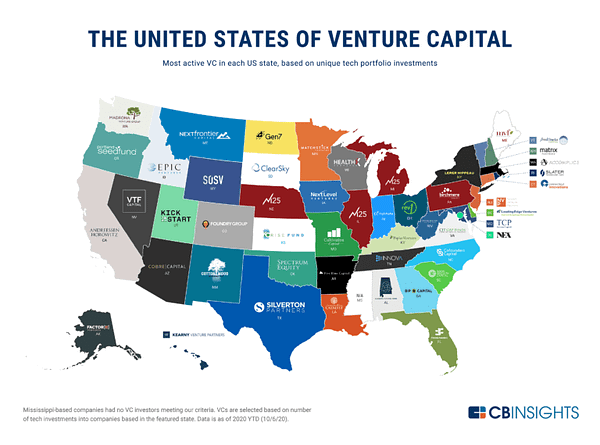

Midwest Venture Capital Firms and Angels

Sponsored Content From Our Friends at Enterprise Rising Conference 2020 ONLINE:

100% startups. 100% Midwest. 100% SaaS. And this year 100% online too.If you're an entrepreneur, come learn from a speaker roster that will be dropping non-stop tactics with no BS.

If you're an investor come to the conference where you will find more startups with real traction than anywhere else in the Midwest.

If you're a supporter of startups, come build relationships with an amazing community of startup people.

Check out the event site for details and use discount code: excoastal for 20% off as many tickets as you need.

Venture Capital Deals

📍 Chicago

Cooler Screens, a startup that replaces the glass doors to store aisle coolers with interactive digital displays, raised $80 million in Series C funding from Verizon Ventures, M12, Great Point Ventures, and SVB.

NOCD, a startup treating obsessive-compulsive disorder, raised $12 million in a Series A funding. Health Enterprise Partners led the round and was joined by investors including 7Wire Ventures, Chicago Ventures and Hyde Park Angels. Term Sheet

📍 Ohio

Datavant, a Cleveland-based health data management company, raised $40 million in Series B funding. Transformation Capital led and was joined by Johnson & Johnson, Cigna Ventures, Roviant Sciences, and Flex Capital.

📍 Indianapolis

Mandolin, a digital platform designed to help artists, venues, and fans connect through live music, has raised $5 million in seed funding. Investors include High Alpha Capital and Marc Benioff.

📍 Pittsburgh

Abridge, developer of an app designed to improve patients’ understanding of their medical care and ability to follow their doctor’s advice, announced that it has raised $15 million across seed and Series A rounds co-led by Union Square Ventures and UPMC. Other investors include Bessemer Venture Partners, Pillar, and KdT Ventures.

📍Denver/Boulder

Engrain, a Denver-based developer of data visualization and mapping software designed to help users identify and manage property, has raised $3.7 million. The round was led by RET Ventures.

Denver-based Good Buy Gear, an online marketplace for gently used baby, toddler, and children’s items, raised $6 million in Series A funding. The round was led by Revolution Ventures and was joined by Access Venture Partners and Relay Ventures.

Exer Labs, a Denver-based fitness startup with a motion coaching apps, raised $2 million in seed funding. Investors include GGV, Jerry Yang's AME Cloud Ventures, Morado Ventures, Range VC, Service Provider Capital, Shatter Fund, and Signia Venture Partners.

📍 Silicon Slopes

Alucent Biomedical, a Salt Lake City-based medical technology company for vascular disease treatments, raised $35 million in Series B funding. Investors included Fresenius Medical Care Ventures. Term Sheet

ICON, a Utah-based connected fitness company whose brands include NordicTrack, raised $200 million in growth equity funding at a valuation north of $7 billion. L Catterton led, and was joined by Pamplona Capital Management. Axios

📍 Texas

HUVRdata, an Austin-based maker of products that help industrial companies integrate data from inspections, raised $5 million in funding. Cottonwood Venture Partners led the round.

Austin-based Everlywell, the maker of Covid-19 home-testing kits, is in talks to raise new funding at a $1 billion-plus valuation, per Bloomberg.

Private Equity Deals

Gridiron Capital has made an investment in Cubii, a Chicago-based provider of elliptical-style fitness equipment, and other wellness services.

YCharts, a Chicago-based maker of cloud-based investment analytics and communications tools for investors, has completed a growth recapitalization in partnership with LLR Partners. Axios

M&A

Quorum Software, a provider of customer management software for the oil and gas industry, has purchased Landdox, a Dallas-based software developer for the energy and infrastructure sectors.

New Funds

RiverVest Venture Partners of St. Louis is raising $200 million for its fifth fund, per an SEC filing.

NewRoad Capital Partners, a Rogers, Ark.-based growth equity and buyout firm, raised $176 million for its third fund.

Others

RootInsurance, a Columbus, Ohio-based auto insurer, filed for an IPO that Renaissance Capital estimates could raise $800 million. It plans to list on the Nasdaq (ROOT) with Goldman Sachs and Morgan Stanley as lead underwriters and reports a $145 million net loss on $245 million in revenue for the first half of 2020. Root raised around $520 million in VC funding, including from Columbus-based Drive Capital which holds a 26.6% pre-IPO stake. Axios

What I’m Reading

VC Fund Returns Are More Skewed Than You Think

The Flywheel #2: Zoom's Meteoric Rise

How Yelp pivoted to helping small businesses during the pandemic

10 Factors To Consider When Evaluating Consumer Subscriptions

Survivors and Thrivers: 25 Small-Business Standouts

Startup/VC Twitter

Podcast Addiction

Rahul Vohra - Using Emotion to Design Great Products - Invest Like the Best

Culture Break

📚Read- On Corruption in America - Sarah Chayes

🎬Watch- Fargo (Series on Hulu)

🎧Listen-

🧐Think- A mentally ill man, a heavily armed teenager, and the night Kenosha burned

If you like Excoastal and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great week!